Small Business Tax Navigator

Get Access for just $99 $9.99! (90% Off Retail Price)

...And Lower Your Tax Bill By $22,860.00 Per Year or More using the little known strategies of America's Richest Families.

“After 25 years of helping people recover cash and lower their tax bill, I can guarantee most accountants and CPAs do not know many of these tax-savings strategies.”

-Garrett Gunderson, Bestselling Author, Entrepreneur, and Financial Advocate

Dear entrepreneur,

If you earn any business or 1099 income, I have good news and bad news for you…

The bad news?

There’s a 93% chance you’re overpaying on your taxes.

The good news?

There are little-known, 100% legal tax strategies you can use to add that lost money back into your life…

Including getting the IRS to send you a check for past years you overpaid…

So you can increase your wealth creation for years to come by keeping more of the money you earn.

It’s the easiest, fastest money you’ll ever make in your life…

Because it’s your money—it’s just going back into your pocket instead of Uncle Sam’s!

Now, Before I Reveal These Tax-Saving Strategies…

…allow me to introduce myself.

Hi, I’m Garrett Gunderson, New York Times bestselling author and financial advocate for entrepreneurs.

I’ve dedicated the last quarter-century to helping business owners lower their tax bill, boost their bottom line without working harder, and save money with cash flow strategies rather than painful budgeting.

After working with thousands of business owners, I discovered that 10% or more of their income is being lost to Uncle Sam, Wall Street, and financial institutions. And you’re probably losing money unnecessarily, too.

If you’re anything like the thousands of business owners I’ve worked with…

For every $500,000 in total annual business revenue, you’re losing an average of $11,430 per year.

Or $22,860.00 in lost income for every million in top-line revenue.

And the numbers just compound with higher revenues.

This is money that is rightfully yours that can be reclaimed with just a little bit of know-how.

I found this out the hard way…

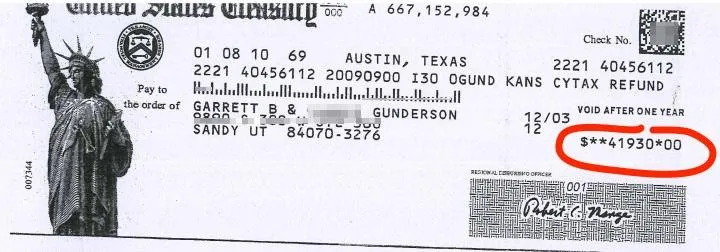

Tragedy Turned into a $41,930 Check From the IRS

Most people fear the IRS…

But not long ago, the IRS sent ME a check for $41,930.

The year before, my business partners had died in a plane crash. It left me stressed, overworked, distracted, reactive, and making emotional decisions.

One side effect was that I didn’t meet with my accountant enough outside of tax season…

And I didn’t ask the questions that I usually ask to discover the best tax strategies…

And ultimately, I didn’t take all the deductions that I was entitled to.

This meant I overpaid the IRS by $41,930.

And it’s not uncommon for business owners to be massively overpaying the IRS like this.

I know this for a fact, because one year I personally worked with 117 business owners…

And we discovered 109 of those business owners – or 93% – were overpaying on their taxes.

Fortunately, after years of studying America’s richest families…

And shadowing tax lobbyists and tax strategists for the ultra-wealthy in closed-door meetings in New York City…

And personally working with thousands of business owners over 25+ years…

I’ve become somewhat of a savant at navigating the tax code with the help of my tax attorneys and team (I’m not a CPA or accountant).

So once I regained clarity of mind after the tragedy of losing my business partners, I took another look at the previous year’s tax return…

And immediately noticed some ways I’d overpaid, plus some more ideas for tax deductions.

I took this to my CPA, notified the IRS, and THEN…

This is the $41,930 check I personally got from the IRS for overpaying on my taxes:

And I got another $91,000 the following year.

The IRS agreed that everything was completely by the book…they sent me the money.

Yet most CPAs don’t know about this… don’t think about this often enough… or are just TOO focused on filing taxes rather than ACTUALLY doing tax strategy.

And it IS a method that I’m very intentional about.

Here’s My Method I’ve Used For 25+ Years to Navigate the Tax Code and Maximize My Tax Savings

Finding new ways to save tax is one of my hobbies, and I’m damn good at it. I started doing it in 1999. I started by studying the ultra-wealthy, including America’s richest families like the Rockefellers, to find many of the best tax strategies out there.

And today, I do these 3 things to continually find new ways to maximize my tax savings…

#1) I Meet With My Carefully Vetted Team, Including my CPA and Tax Attorney Every Single Quarter (and OUTSIDE of Tax Season)

Most people meet with their CPA right before their taxes are due, after most of the best strategies expired (the previous year).

This is called “tax season,” and it’s when your CPA is the busiest, the most tired, and the least likely to bring up new ways to save on taxes.

That’s why I meet with my CPA and tax attorney every single quarter…

Now they’re fresh, they’re at their best, they’re willing to brainstorm and let me bounce ideas off of them… and they bring new ideas to ME about how to save more tax.

(And my tax attorney – who also trains the best tax attorneys out there for a living – actually gives me more strategies than my CPA does.)

Only meeting with your tax team during tax season means you’re getting bottom-of-the-barrel tax advice.

#2) I Tie Every Expense I Can to the Business (Even If It’s Just a Partial Deduction)

Anytime I spend money, I ask myself:

Does this relate to my business?

If so, it may be a tax deduction.

Does it relate to my business SOME of the time?

Then maybe it’s a partial deduction.

#3) I Ask Crazy and Not-So-Crazy Questions

For example…

How can I write off some of my clothes?

Normally new clothes aren’t a valid deduction. But I asked my CPA about it and we came up with a solution.

A uniform is a valid deduction, but if you could wear it day to day, it doesn’t count...unless, you have a certain type of company, then it becomes a write off.

How can I write off part of my family vacation to Italy?

Well, it turns out that my business partner (my wife) and I do our best thinking when we’re in Italy, so we held company meetings there, documented everything, and got to write off part of our trip.

I also like to ask:

What’s the best tax strategy you’ve implemented for other clients recently?

That way I’m continually getting the best tax strategies that others are using, and that I may never have thought of.

Every time I implement this method, I find multiple new ways to save on tax.

And it’s about MORE THAN JUST TAX DEDUCTIONS… it is how you take your income, the type of company you chose, and how you chose to pay yourself. This can remove 15.3% tax in some cases. Thanks to one recent tax law, you can go from 37.5% to 29%—or even as low as 20%!

This guide isn’t just about deductions, but how to classify or reclassify your income. This is about the principles and structures for systematically lowering your tax bill.

After doing this for 25+ years, I’ve compiled all the best tax strategies that save business owners the most tax possible…

And I’ve put them all into one valuable resource I want to get in your hands today.

This Tax Navigator Playbook Contains 25+ Years of My Work Tracking Down the Best Tax Strategies

And it reveals tax strategies typically reserved for America’s richest families and the ultra-wealthy.

And from decades of experience, I can pretty much guarantee you that your CPA doesn’t know many of them and is basically giving your money away to Uncle Sam.

CPAs are often more historian than strategist. Filing your taxes rather than creating strategies to legally reduce your taxes.

You can read the Tax Navigator playbook yourself and see what strategies might work for you. Or you can just send this playbook to your CPA to review and see what they may be missing.

Here’s exactly what you get with the Tax Navigator…

You get a detailed workbook and assessment. It pinpoints areas where you can make substantial savings on taxes. This immediately increases your cash flow without you working harder.

You get powerful questions, checklists, and tax-savings frameworks to customize to your business.

These are legal, ethical, straightforward strategies. There is no gray area, so there’s no additional audit risk or loss of sleep.

And deductions are only a fraction of the story in saving tax and stopping the leaks.

In some cases, there are ways to access money or sell assets completely tax free.

Here’s just SOME of what you’ll discover inside…

How to turn active income into passive income so you can pay less tax

Tax-free income strategies that also let you be charitable at the same time

The tax strategies you always want to implement BEFORE December 31st, and not during tax season (and I’m NOT talking about maximizing last-minute deductions, which is often the WRONG thing to do)

4 tax professionals to work with besides a CPA that could automatically save you much, MUCH more than their fee

A little known and under-utilized accounting technique to reduce your tax liability and increase cash flow

How to rent your house to your business… and keep the rental income tax-free

Why “conservative” CPAs are fearful CPAs, and how they’re costing you money

Why deferring tax isn’t saving tax at all

A new 2017 tax law that allows many business owners to deduct up to 20% of their qualified business income

How to write off all or part of a corporate retreat

How to hire your kids tax-free… it’s a deduction for you and tax-free income for them that can be used for clothes, education, savings and more

TAX ARBITRAGE STRATEGIES – How to spend 1 dollar and save more than 1 dollar in tax

Willing to move out of your state? Then you can eliminate ALL income tax

How to turn ordinary income into capital gains so you can pay less tax

How to sell your business TAX FREE for up to $10 million.

My “Three to the Third” tax savings framework that you can customize for any business. (At the last conference I spoke at, people told me this one resource was worth more than what they paid for the whole three-day event)

Are you confident in the type of corporation you selected for your business(es) to maximize tax savings? We’ll break it down for you…

The #1 blind spot successful business owners have about the taxes they’ll pay in the future

Matt C. Saved $320,000 in Taxes!

I’ve shared these strategies in front of thousands, sharing the stage with world renowned speakers like Richard Branson, Tim Ferriss, Tony Robbins… and even the Dalai Lama…

I’ve shared them in my bestselling books…

I’ve shared them personally with celebrities you’d know but I can’t name here (Like Hollywood directors, actors and even some rappers… I even helped one multi-platinum artist save hundreds of thousands by setting up a production company for their music videos, social media, and areas where they were massively overpaying without having the right type of corporation.)

And of course my team and I have shared them with thousands of business owners one on one.

And people are experiencing amazing results.

For example…

Made $10,000,000 Tax-Free: Brad and Nate just sold their business and used a special “1202” exemption that I shared with them, and it allowed them to take $10 million each tax-free.

$320,000 Check From the IRS: Matt’s accountant made a mistake on his taxes, and we were able to amend his returns, returning him $320,000 of overpayment for the previous three years. This works for 1 in 3 business owners in my experience.

$250,000 Tax Deduction: Then there was Alan, one of my first clients. He sold his business for 1.7 million dollars, received a $250,000 tax deduction, and paid zero tax…all while benefiting a charity of his choice.

For example…

An Extra $6,500 Per Month: Dr. Grace Syn was floored when we found an extra $6,500 per month for her. Not with budgeting, but by saving tax, negotiating better interest rates, and redesigning insurance plans.

Nearly $1 Million Recovered: We helped Dr. Jim B recover almost $1 million in measurable cash over the last decade with tax credits and redesigning loans and insurance policies

$3,000+ More Per Month: In just our first meeting with Charlie W. alone, we saved him $3,400 in monthly cash flow.

And these are just a handful of examples.

Get the Tax Navigator Playbook Now and See How Much You Can Save

As a business owner, you know that cash flow is the lifeblood of your business.

The Tax Navigator will show you exactly how to increase your cash flow immediately.

And it’s critical that you take action now.

Because do you leave a hefty tip for a bland meal with crummy service?

Then tell me this: Why are you tipping the government so much in taxes you shouldn’t be paying?

You can stop tipping the government today.

Let’s take that money back from Uncle Sam and put it back in your pocket where it belongs.

You can utilize my framework in the Tax Navigator playbook, take the assessment to see where you may be overpaying tax, and use the checklists to see what strategies apply to you.

Implement the strategies yourself, or just hand the playbook over to your CPA to do it for you.

Either way…

The Tax Navigator Playbook is Just $9.99

You can get the Tax Navigator playbook with all of the checklists, frameworks, tax-savings questions for your CPA and more…

Including the table from Section 2 which I’ve been told is INVALUABLE by itself…

All for just $9.99.

Yes, that’s all.

Which is incredible when you consider these tax strategies have literally saved millions of dollars for the business owners my team and I have worked with.

Why so cheap?

Well you can learn all of these tax-savings strategies I have for you, implement them for yourself and hopefully save thousands of dollars per year.

And if that’s all the interaction we have together, I’ll still be thrilled.

But if you see the value in learning a few strategies to keep more of the money you make, there’s a lot more where that came from.

And I’m making a bet that by giving you the Tax Navigator for so cheap today, you’ll be back for even more value in the future.

Of course, there’s no obligation and you owe me nothing.

It’s my pleasure to give you the 25+ years of tax strategies in Tax Navigator for just $9.99 today.

PLUS…

I Guarantee You’ll Find at Least 1 Strategy that Saves You 100x Today’s Price of the Guide… Or Your Money Back!

These are the best, most effective tax-savings strategies I’ve found after 25+ years of searching for them.

I’m 100% confident that they can save you tax.

In fact, if you don’t find at least 1 strategy that saves you 100x the price of today’s guide (that’s $1,000)...

Or if you’re anything less than absolutely thrilled with what you see in the Tax Navigator playbook…

Then just let us know within 30 days, and we’ll give you a complete refund.

No questions asked.

The Time to Dramatically Lower Your Tax Bill is Right This Second…

I don’t know about you, but it makes me angry to see people paying more than they owe in taxes.

I’m certain you would make better use of that money than the government does.

And that’s why I want to help you recover as much money in overpaid taxes as possible.

Let’s take that money back from the government and put it back in your pocket where it belongs.

Click the button below to get started now.

In prosperity,

Garrett Gunderson

P.S.

If you feel guilty for paying less in tax, remember, this is only income tax. You still get hit with like a dozen other taxes: you have to pay tax to live, to work, to eat, to drive, to buy, to sell, and if you don’t plan well, even when you die. Stop tipping the government, reclaim your cash, and improve your life!

Copyright 2024 Garrett Gunderson | All Rights Reserved